Former President Bush said during his speech that he wishes the cuts weren't called the "Bush Tax Cuts" because he said, "if they were called some other body's tax cuts, they'd be less likely to be raised."

Obama has vowed to rid of these tax cuts, and raise taxes for Americans that make more than $1 million in income by January, if re-elected. This seems like it would be great news for everyone who makes under $1 million a year, but it is actually not as good news as one might initially suspect.

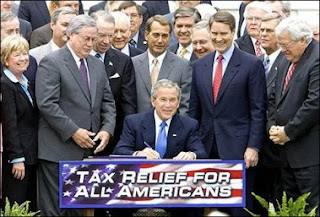

President Bush Signing the Economic Growth and Tax Relief Reconciliation Act of 2001 (Thereafter Affectionately Referred to as the "Bush Tax Cuts")

President Obama wants to raise taxes on the wealthiest Americans, who already contribute over 40% of all taxes paid in the country. What we really need is a comprehensive plan to get for long-term economic growth, and to shift away from the absurd deficit we, as a country, are facing -- and waging some sort of "class warfare" is not the proper solution to this problem.

As Ronald Reagan faced the economic and unemployment crises during the first term of his Presidency, he put into place his concept of trickle-down economics, also known as "Reaganomics." The result of Reaganomics was that it created 22 new million jobs. We are far from creating that many new jobs today, as the unemployment rate is currently around 8.2% as of March 31, 2012.

Personal entrepreneurship by American citizens has proven to create more jobs, and therefore generate continuous growth in the economy. Government control of enterprise has yet to prove its success (at least not in America, maybe in China...that's good for them).

Ultimately, if some sort of compromise between the President and the House Budget Committee is not reached in the near future, we could face a national debt crisis. In such a scenario, the first to suffer will be the critics of the "Bush Tax Cuts", the same people who are most economically dependent on the government.

Chart Comparing Unemployment Rates & Annual Deficits Under The Bush Administration (2000-2008) Versus The Obama Administration (2008-Present)

I agree, there was a boom in the mid 80s, and the economy recovered from a severe recession. However, while the rich got so much richer, there was little sustained economic improvement for most working and marginalized Americans ( I can provide you data if you want) . By the late 80s, middle class incomes were barely higher than they had been a decade before. The poverty rate had actually risen. During Reagan's first term, homelessness became a visible problem in America's urban centers and crack epidemic was rampant.

ReplyDelete